A B C D E F G H I J K L M N O P Q R S T U V W X Y Z A B C D E F G H I J K L M N O P Q R S T U V W X Y Z A B C D E F G H I J K L M N O P Q R S T U V W X Y Z A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

英文姓名相关资料:

在英语中,按照国际规范,中国人名如何书写? - 知乎 为什么《明末:渊虚之羽》的英文名翻译为Wuchang:Fallen Feathers? - 知乎 怎么给自己起个英文名? - 知乎 有没有J开头的英文名? - 知乎 有哪些不烂大街的男性英文名? - 知乎 有哪些堪称精妙的谐音中英文名? - 知乎 中文名字如何正确翻译成英文? - 知乎 Last name 和 First name 到底哪个是名哪个是姓? - 知乎 如何看待河南医药大学(原新乡医学院)英文名为Henan Medical University? - 知乎 有哪些c和s开头的好听女生英文名? - 知乎

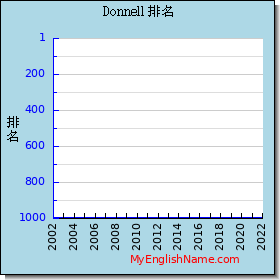

Donnell 查看英文字典解释与翻译 复制到剪贴板

年度 常用排名名次 2022 --- 2021 --- 2020 --- 2019 --- 2018 --- 2017 --- 2016 --- 2015 --- 2014 --- 2013 --- 2012 --- 2011 --- 2010 --- 2009 --- 2008 --- 2007 --- 2006 --- 2005 --- 2004 --- 2003 --- 2002 ---

英文每年常用名排名2023 年排名 2022 年排名 2021 年排名 2020 年排名 2019 年排名 2018 年排名 2017 年排名 2016 年排名 2015 年排名 2014 年排名 2013 年排名 2012 年排名 2011 年排名 2010 年排名 2009 年排名 2008 年排名 2007 年排名 2006 年排名 2005 年排名 2004 年排名 2003 年排名 2002 年排名 2001 年排名 2000 年排名 希伯来 希腊 条顿 印度 拉丁 拉丁语 古英语 英格兰 阿拉伯 法国 盖尔 英语 匈牙利 凯尔特 西班牙 居尔特 非洲 美洲土著 挪威 德国 威尔士 斯拉夫民族 古德语 爱尔兰 波斯 古法语 盎格鲁撒克逊 意大利 盖尔语 未知 夏威夷 中古英语 梵语 苏格兰 俄罗斯 土耳其 捷克 希腊;拉丁 斯干那维亚 瑞典 波兰 乌干达 拉丁;条顿 巴斯克语 亚拉姆 亚美尼亚 斯拉夫语 斯堪地纳维亚 越南 荷兰